Tax Cuts and Jobs Act of 2017: What It Means for Workers and Unions

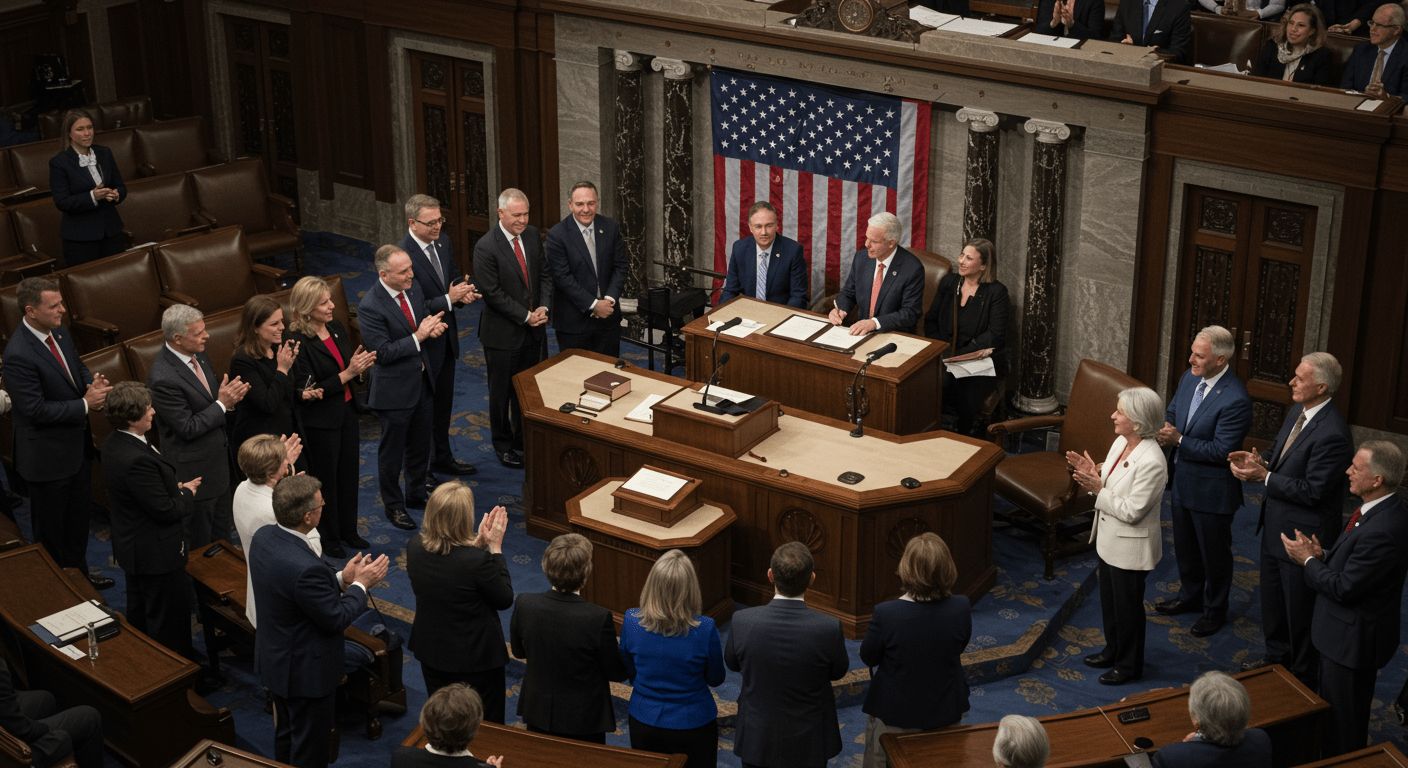

The Tax Cuts and Jobs Act of 2017 (TCJA) was one of the most significant overhauls of the U.S. tax code in decades. Signed into law by President Donald Trump, the TCJA aimed to stimulate economic growth by lowering corporate tax rates and simplifying individual tax brackets. While it was touted as a win for businesses and middle-class Americans, the legislation’s impact on workers and labor unions has been more complex.

This article explores who benefits from the TCJA, its pros and cons, and specific implications for union members, including the treatment of legal fees under the law.

In This Article We Will Discuss:

- What Is the Tax Cuts and Jobs Act of 2017?

- Tax Cuts and Jobs Act of 2017: Who Benefits?

- Pros and Cons of the Tax Cuts and Jobs Act of 2017

- Legal Fees and the Tax Cuts and Jobs Act

- How the TCJA Affects Union Members

- Tax Planning Tips for Workers and Union Members

What Is the Tax Cuts and Jobs Act of 2017?

The Tax Cuts and Jobs Act, enacted on December 22, 2017, introduced sweeping changes to individual and corporate tax structures. Key provisions include:

- Corporate Tax Rate Reduction

- The corporate tax rate was slashed from 35% to 21%, the largest reduction in decades.

- Individual Tax Changes

- Adjustments to tax brackets, with the top rate reduced from 39.6% to 37%.

- Doubling of the standard deduction to $12,000 for individuals and $24,000 for married couples filing jointly.

- Cap on State and Local Tax (SALT) Deductions

- SALT deductions were capped at $10,000, disproportionately affecting taxpayers in high-tax states.

- Limitations on Miscellaneous Deductions

- Eliminated deductions for union dues and unreimbursed work expenses.

Tax Cuts and Jobs Act of 2017: Who Benefits?

The TCJA primarily benefits corporations and high-income earners, though it also provided modest relief to middle-class taxpayers.

Winners

- Corporations

- The 14-point reduction in the corporate tax rate resulted in billions in tax savings, allowing companies to reinvest or increase shareholder payouts.

- High-Income Earners

- Wealthier individuals benefited from the lower top tax rate and expanded estate tax exemption.

- Some Middle-Class Families

- Families with children gained from the doubling of the child tax credit to $2,000 per child.

Losers

- Workers in High-Tax States

- The SALT deduction cap significantly increased tax burdens for residents in states like California and New York.

- Union Members

- The elimination of deductions for union dues and job-related expenses disproportionately impacted union workers.

- Gig and Contract Workers

- While some independent contractors benefited from the new 20% qualified business income deduction, many faced challenges navigating the new rules.

Pros and Cons of the Tax Cuts and Jobs Act of 2017

Pros

- Economic Growth

- Supporters argue that the TCJA spurred economic growth by incentivizing businesses to invest and hire.

- Simplified Tax Filing

- Doubling the standard deduction reduced the need for itemizing, making filing taxes easier.

- Lower Individual Tax Rates

- Most taxpayers saw reductions in their effective tax rates, leading to increased take-home pay.

Cons

- Disproportionate Benefits

- Critics contend the TCJA primarily benefited corporations and the wealthy, exacerbating income inequality.

- Increased Federal Deficit

- The Congressional Budget Office estimated the TCJA would add $1.9 trillion to the national debt over a decade.

- Loss of Worker Deductions

- The elimination of deductions for union dues, travel, and uniforms hurt middle-class workers.

- Temporary Individual Tax Cuts

- Corporate tax cuts are permanent, but most individual provisions will expire in 2025, creating uncertainty.

Legal Fees and the Tax Cuts and Jobs Act

The TCJA introduced significant changes to the deductibility of legal fees, affecting both individuals and unions.

Impact on Individuals

- Previously, taxpayers could deduct legal fees associated with employment disputes or discrimination claims.

- The TCJA eliminated this deduction, increasing out-of-pocket costs for workers pursuing workplace justice.

Impact on Unions

- Unions can still deduct legal fees for collective bargaining, grievances, or arbitration as business expenses.

- However, the elimination of individual deductions indirectly shifts financial burdens onto members.

How the TCJA Affects Union Members

Loss of Union Dues Deduction

Before 2018, union members could deduct dues if they exceeded 2% of their adjusted gross income. Eliminating this deduction has significantly impacted unionized workers.

Wage Gains and Job Security

While the TCJA’s proponents argued lower corporate taxes would lead to higher wages, evidence suggests many companies used tax savings for stock buybacks instead of increasing pay.

Union Advocacy

Unions have been actively lobbying for the restoration of deductions for union dues and unreimbursed expenses in future tax legislation.

Tax Planning Tips for Workers and Union Members

- Maximize the Standard Deduction

- Bundle charitable contributions or medical expenses to exceed the standard deduction.

- Seek Union Assistance

- Utilize union resources, such as workshops or financial planning tools, to navigate tax changes.

- Track Work-Related Expenses

- Though no longer deductible, tracking expenses can help with reimbursements or future tax changes.

- Monitor Legislative Updates

- Stay informed about proposals to restore deductions for union dues or work expenses.

Conclusion

The Tax Cuts and Jobs Act of 2017 reshaped the tax landscape, creating winners and losers among individuals, businesses, and unions. While corporations and high-income earners benefited, many workers—especially union members—experienced setbacks due to the loss of key deductions.

As the 2025 expiration of individual provisions approaches, workers and unions must advocate for reforms addressing these disparities. By understanding the TCJA’s impact and planning proactively, union members can navigate challenges while continuing to fight for policies that benefit the working class.